Bonus Depreciation, Short-term Rental Loop Hole, and Wealth Building through Tax Strategies

Unpacking tax strategies in short-term rental investing - a primer

💰 Why STR Tax Strategies Matter More Than Ever in 2025

I spent years in the 9-to-5 grind, paying my taxes without thinking twice—until I discovered short-term rental (STR) investing. While I quickly grasped property management and guest experience, tax strategies took much longer to sink in.

And yet, tax strategy is the secret sauce to real wealth generation in real estate.

The reality? Most STR owners don’t know how to leverage the tax code to their advantage. I sure didn’t at first—I have an MBA, but I still felt lost when people talked about depreciation, cost segregation, and tax loopholes. And I talk to people all the time who are a bit sheepish to admit not only do they not understand tax code - but they are struggling just with business basics like expense categories for taxes!

So, I created this guide to break it down in a way that makes sense—no jargon, no CPA required (and keep in mind - I'm NOT a CPA here so don't take this as advice from one!)

🚀 What You’ll Learn:

✅ How STR owners can offset W2 income with tax losses

✅ What bonus depreciation is (and why you should care)

✅ The "STR Loophole" that could reduce your tax bill

✅ Key tax strategies for active vs. passive investors

The Lure of Bonus Depreciation

No question, some folks who have considered or jumped into short-term rentals are curious about or planning to utilize tax strategies to offset tax liabilities. Bonus depreciation is a powerful tool in our tool box but its a bit complex if you are just jumping into the world of real estate investing and short-term rentals. While its in the process of phasing out, recently introduced legislation would reboot the benefits of bonus depreciation, so its timely to discuss. This tax incentive can help you accelerate the depreciation of eligible assets, allowing you to write off a significant portion of their cost in the first year of purchase. Before we dive into the world of bonus depreciation and how it can benefit your short-term rental business, though, let's talk about the short-term rental tax loophole.

Types of Income

In the world of taxes, there are different buckets of income - active and passive.

➡️Active income is income we’ve exchanged time for money - so our W2 job.

➡️Passive income is like dividends - we make the investment, and it makes us money on autopilot.

House flipping - any home ownership of less than a year, is typically considered active and taxed differently but any rental property owned for more than a year is taxed as a passive investment. There IS some give in this - a certain amount of passive loss might be able to offset active but all that has caveats best discussed with your tax professional.

Short-term Rental Loophole

The IRS considers owning rental property passive income. Sure, there is some work involved but overall the income from rental properties can be pretty low-key effort earnings compared to the returns. The implications is that if we, in the first year of earning a property, put a bunch of money into it and earn very little - its a loss. Say it’s a $10K loss for this example. And in the W2 job, maybe you’ve paid in $25K taxes, and you owe another $7K. It seems like you could offset what you owe from your W2 job in taxes could be offset by the fact that you lost money on your real estate project, but with some exceptions generally that’s not the case.

However, the IRS allows for - in some cases where you can prove very active effort, that rather than being an investment your short-term rental business is an active business not a passive investment; the real estate is just as aspect of the business, not the focus. Most of us appreciate that a short-term rental requires a lot more work than long term rentals so the "loophole" is a way to recognize that - if you are the one doing the work. So if, in year one, setting up the property, investing in upgrades, furnishings etc and that’s a loss - because you are the person who spent the most time working on the property and have at least 100 hours of active time in the property - and that’s more than anyone else, it could be considered an active loss and offset that W2 tax liability. Again, there are some allowances and exchanges between active and passive rules, but in general the idea of the "loophole" is to offset your tax liabilities on your active income. Especially for business owners and high wage earners, this can be an especially engaging prospect - doubly so when considered again the lure of owning a vacation rental (especially if it happens to be in a market where you vacation anyway!)

✅Grab my FREE GUIDE: The STR Tax Playbook to grab key insights to how to use these strategies!

Real Estate Professional Status (REPS)

The IRS has a designation for individuals spending 50% or more of their professional time in real estate activities - that's 750 hours+. The real estate professional status enacts much the same effect as the short-term rental loop hole if applicable.

Material Participation

That test to “prove” that you were highly engaged and active in the short-term rental business is called Material Participation, and there is a “test” to prove it. Keep in mind that there is always some interpretation involved - so questions of “does this count toward my material participation hours” is something your CPA should answer for you, and different CPA will have different responses - in part based on court cases but if there is not legal precedent then it's a matter of more or less conservative, firm policies, etc.. Keeping good records is key, as is being consistent. Learn more HERE about material participation and keep in mind as a strategy, while helpful it will be important to maintain solid records of your time.

Bonus Depreciation

Bonus depreciation for short-term rentals - also known as the additional first-year depreciation deduction, is a tax incentive designed to stimulate business investment. Thanks to the Tax Cuts and Jobs Act (TCJA) passed in 2017, businesses were able to immediately write off 100% of the cost of eligible property acquired and placed in service between September 27, 2017, and December 31, 2022. This allowed for substantial tax savings and reduced taxable income; but its benefit decreases each year; 40% in 2025 and 20% in 2026 and then it was SUPPOSED to be gone.

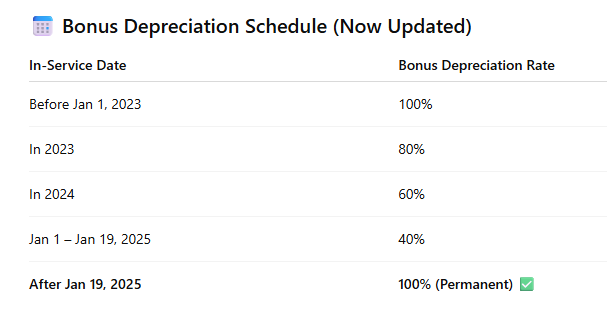

🚩But new legislation signed into law July 4, 2025 reintroduced 100% bonus depreciation effective Jan. 19, 2025. This means if you put your property into service after 1/19/25 you are eligible for 100% bonus depreciation. Here's the updated schedule:

But first - what IS depreciation?

Let’s talk for a minute about depreciation - not the “bonus” variety I just mentioned that lets you immediately write off 100% of the cost but plain o’ depreciation as its been around for generations which traditionally allowed for businesses, including rental properties, that acquire physical assets to allocate the cost of these assets over their useful life, effectively spreading the expense across several years rather than taking the full hit in the year of purchase. In the context of real estate investing and short-term rentals, this means that if you buy a property to rent out, you can't deduct its entire purchase price from your income in the year you buy it. Instead, you deduct a portion of the property's value each year, over a period that the IRS specifies (typically 27.5 years for residential property). This process acknowledges that the property, like any physical asset, gradually wears out, loses value, or becomes obsolete over time.

🗝️ In Service Date. Depreciation starts the moment you make the property available for rent (when your short-term rental is "in service") and continues each year until you've fully depreciated the property's cost or you sell it.

This can significantly reduce your taxable income from the rental property each year, thus lowering your tax bill. For example, if you purchase a rental property for $275,000, you might be able to deduct around $10,000 each year for 27.5 years in depreciation expenses. This doesn't include the land value, as land is not depreciable.

Bonus depreciation for short-term rentals allows investors to deduct a larger percentage of the asset's cost in the first few years, accelerating the benefits. This can be especially advantageous for investors in short-term rentals.

Keep in mind that depreciable expenses are specifically defined by the IRS (see the info HERE); improvements and expansions (not repairs or maintenance), furniture and appliances, and the cost of acquiring the house (but not the land) all may be depreciable and eligible for bonus depreciation. Again, I’m not a tax professional so talk to yours!

Short-term Rental Loop Hole + Bonus Depreciation

You don’t need the short-term rental loophole to take advantage of bonus depreciation. The loophole is a way of offsetting active income; but someone with a lot of passive income would prefer to have that loss on the passive side. Again, these are strategies that need to consider your full situation, goals, and requirements. Don't miss my FREE GUIDE that walks through these strategies!

Cost Segregations

Many folks talk about bonus depreciation and cost segregations in the same breath, so lets unpack this as well.

Essentially, a cost segregation study is a detailed analysis performed on a property to identify and reclassify portions of the property that can be depreciated over a shorter period, typically 5, 7, or 15 years, instead of the standard 27.5 or 39 years. This process focuses on breaking down the purchase price or construction cost of the property into various components, including personal property (such as fixtures, furniture, and equipment) and land improvements (such as landscaping, sidewalks, and parking lots), which have shorter depreciation lives than the building itself.

By accelerating the depreciation deductions, investors can significantly increase their cash flow in the early years of the investment. This is because the higher depreciation expenses reduce taxable income, thereby lowering taxes owed. For instance, if a portion of the property's cost attributed to fixtures and fittings can be depreciated over 5 years instead of spreading it over 27.5 years, the investor can claim larger tax deductions sooner.

Cost segregation studies are particularly beneficial for new property acquisitions, construction, or properties that have recently undergone significant renovations. While the upfront cost of conducting a cost segregation study can be significant - and until more recent times seen as beneficial only for larger commercial projects due to the cost, the potential tax savings - especially in the era of bonus depreciation, often far outweigh these costs, making it a valuable tool for maximizing profitability and improving cash flow in the short term.

It's a strategy that, when used wisely, can make a substantial difference in the financial performance of real estate investments, especially for those in the short-term rental market or with a sizable portfolio of properties. Engaging with professionals who specialize in this area is crucial to ensure the accuracy of the study and compliance with tax laws, ultimately unlocking the full potential of cost segregation benefits.

How much does it cost and what’s the benefit? A firm is likely to charge thousands of dollars - and the return is probably tens of thousands. Talk to the firm, they probably can give you an idea of the benefit upfront.

Recapturing Depreciation

So having utilized bonus depreciation the downside comes at the time of sale, and this is why having a knowledgeable team and goal clarity in your business is key. If the property sells for more than its depreciated value, (the original purchase price minus all claimed depreciation during the period of ownership), the IRS requires the owner to pay a depreciation recapture tax on the amount of depreciation taken. This tax is calculated at a specific rate (currently 25% for real estate), which can significantly impact the net proceeds from the sale. Essentially, while depreciation benefits the investor by reducing taxable income during the ownership period, recapture tax reduces the tax benefits upon sale by taxing the previously deducted depreciation.

So the decision to use bonus depreciation should not be taken lightly, and should be decided in the context of overall investment plans. However, its not all gloom and doom if the plan was never to hold a property long term or if you find yourself in a position to need to sell; the impact can be mitigated.

For instance, if a property is sold at a loss, meaning the sale price is less than the adjusted basis (original purchase price plus improvements minus depreciation), there may be no need to recapture depreciation, as there's no gain to tax. We hope that’s never the case, but sometimes it is and at least its not a double wallop!

Additionally, if the property qualifies for a 1031 exchange - a tax-deferred exchange that allows investors to sell a property and reinvest the proceeds in a new property without paying capital gains or depreciation recapture taxes immediately, the effect of depreciation recapture can be postponed. This strategy is particularly beneficial for investors looking to upgrade their portfolio or move investments without taking a significant tax hit in the process.

It's worth noting that while these strategies can defer or minimize taxes due, they often require careful planning and adherence to specific IRS rules; have I hammered home the “work with a tax professional” message enough yet?

. The decision to sell a property and potentially recapture depreciation should be made with a comprehensive understanding of the tax implications and how they align with the investor's long-term financial goals. In some cases, holding onto a property or leveraging tax-deferral strategies like the 1031 exchange might be more advantageous than facing a large tax bill from depreciation recapture.

Postponed Recapture

So a life-goal to build wealth can kick the can of tax recapture all the way down the road to your death and your heirs inheritance at which point the cost basis resets and essentially that recapture never happens when done through good estate planning and use of a Trust. This is a beautiful strategy. The downside is you never “get” your invested funds back.

Okay, that’s totally false you absolutely can pull funds from investments such as a cash-out refi, equity lines of credit and the like. Of course, owning the asset comes with work of some level; it comes with responsibilities that you may not want in your golden years. I’ll be making sure my kids are ready to manage our assets when I’m ready to step back

And if it's right for you - sell the asset and pay the taxes too if that works better. This isn’t right or wrong, it's your life vision and there are lots of ways to approach it. Committing to build a legacy to leave to your heirs while at the same time achieving your personal lifestyle goals seems like a laudable goal to me, whatever that looks like for you. I know my folks legacy - and many of my friends parents, is focused on raising kids who are self-sufficient and leaving behind memories and not much else; And that's cool, too. The point here is it IS possible to kick the can all the way down the road and essentially out run recapture, at least for those assets put in trust.

How It Works with Other Peoples Money

It costs money to get into short-term rentals. So the idea of not having money and being able to get into ownership means using other peoples money. Yes, its possible but like any form of real estate investing without funds generally means partnering in some way. I'm not going to get into this here, but regardless of how you come up with the funds - you can use these strategies. Material participation, however, I have been told that in a partnership only one person can claim it (married partners has some different requirements so check with your tax advisor) until the portfolio has hit at least 5 properties owned in the partnership. But if the funds are simply lent and you are the sole owner, that's not an issue either.

A Case Study

🏖️ Started with a tax strategy with the bonus of funding a vacation home.

A client I worked with started off as a high-earner looking to have a vacation home and leverage the short-term rental loophole. They purchased a property, refurbished it and set it up themselves, got a cost-seg study, ran it, and had a significant loss year 1 due to bonus depreciation which offset their active income tax burden. Year 2 they paid taxes on the revenue generated, offset by the expenses.

💰The Lure of Generational Wealth

They had so much fun, by the end of year two they had an opportunity and wanted to jump in on a boutique motel and wanted to sell the property and make the leap; the motel property had a residence they were moving into.

Selling their vacation rental outright without reinvesting would have required a big tax bill on the depreciated expenses, but they were able to do what's called a 1031 exchange - reinvesting the money within the 1031 requirements into another investment.

There are many ways they could have approached this - the key issues for them were time; they didn’t want to keep managing the vacation rental, and they needed funds to acquire the motel. They could have retained the vacation rental property and pulled any equity out but they didn’t want to be over-leveraged. They were selling their primary residence but that, too, was a fairly recent acquisition so the equity gain was minimal. They could have raised the money needed, but this was a total lifestyle overhaul and its worked for them.

✅A lifestyle is born

Last I heard, they would be pulling funds out of the property within 2 years given the refurbishment and increased revenue; a cash-out refi would have lined their pockets nicely, the motel would be funding their lifestyle needs.

Conclusion

If you know my story, you know I leveraged a life-long interest in real estate and jumped first into exploring real estate investing and in short order landed squarely into short-term rentals. The tax benefits were immediately helpful to my husband and I, but the vision for how and what we could be doing for ourselves, our kids, and their kids became a shiny goal as we learned more. The tax strategies have allowed us to think differently about what acquisitions would make sense - and the long-term trajectory and goals. While it was never about leaving my 9-5, that did happen and its had some downstream impact on how quickly we built out the portfolio - the first goal at that point was to stabilize income, and then return to portfolio growth but all along tax strategies have been integral to our plans. Clearly, I went from confused about depreciation to using it as a primary strategy in our toolbox - something I've seen happen for others.

I've also seen folks jump into STR expressly to gain a vacation home and leverage the tax benefits.

Whatever strategies you use, tax strategies should be considered and where appropriate - leveraged as part of your overall financial wealth goals.

***

My business The CEO Host is all about helping STR owners and manger run their business like a Boss; around here, we leverage solid business principles, goals, and lifestyle focused investing to achieve our life's vision. We laugh at ourselves for taking on too much, reward ourselves for leveling up not just our lives - but our kids lives too, and live intentionally. If you are looking for some help to achieve this, lets CHAT and see how I can support you - be it getting more clarity, more organized and efficient, or just starting. My corporate experience, education, and logical, strategic approach to business has been a boon to short-term rental owners, operators, investors. I'm here to help those seeking to be in achieving goals faster with more confidence.

If you'd like to receive updates from The CEO Host, join our email list. No spam, just the occasional update to help your Short-term Rental business! Sign Up HERE

Find Me on FACEBOOK or Instagram or LinkedIn as @theceohost

*****

Hey Boss! I'm Kate, owner/founder of The CEO Host. If you are interested in taking a leap into short-term rentals - or have some questions about your existing business, my goal - passion, and career, is to help YOU succeed. I've coached hundreds of folks getting started or looking to optimize, analyzed more deals (and duds) than I could count, completed thousands of hours of education and training, attended conferences... So don't be shy. A good CEO knows to bring in expert help - and that's what I'm here for! Lets HOP ON A CALL and chat!

Categories: : tax

Kate Stoermer

Kate Stoermer