Short-Term vs Long-Term vs Mid-Term Rentals: An Essential Guide for Real Estate Investors

Compare short-, mid-, and long-term rentals by income, risk, operations, and tax impact so you can choose the right strategy for your goals.

Affiliate Disclosure: Some of the links in this post are affiliate links, including partners such as AirDNA, Waivo, PriceLabs, and OwnerRez. If you click through and make a purchase, I may earn a commission, at no extra cost to you. These partnerships help support the free education and resources I share here on The CEO Host. I only recommend products and services I personally use or would recommend to clients.

If you own (or are eyeing) a property and wondering, “Should this be a short-term, mid-term, or long-term rental?” this guide is for you. We’ll walk through:

■ How STR, MTR, and LTR are actually defined (and why the answer is “it depends”)

■ The trade-offs in income, risk, and time for each rental type

■ A side-by-side comparison chart of STR vs MTR vs LTR

■ How tax strategy (including the short-term rental “loophole” and bonus depreciation) fits into the picture

■ When it makes sense to pivot from one strategy to another and

■ what to watch for in your exit plan

Quick note: I’m not a CPA, attorney, or financial advisor. This is for educational purposes only. Always confirm strategy with your tax and legal pros for your specific situation.

1. What is meant by STR, MTR, and LTR?

One of the most confusing parts of this conversation is that there is no single universal definition. Federal rules, state laws, and local ordinances may all use slightly different terms. Some cities actually define short-term rentals as 90 day or fewer rentals, although its not as common as fewer than 30 nights! So double check your locality requirements.

A few anchors to work from:

-

IRS definition (for tax purposes):

The IRS considers a property to be a short-term rental if, during the year, the average length of stay is 7 days or less (total rented nights ÷ total stays). If it’s more than that, the IRS tends to treat it like a more traditional rental for tax purposes. -

Common marketplace definitions (what most hosts mean):

-

Short-Term Rental (STR):

-

Usually less than 30 days per stay

-

Almost always furnished

-

Guests are vacationers, business travelers, event travelers, weekenders

-

-

Mid-Term Rental (MTR):

-

Typically 30–180 days per stay

-

Often furnished, but the “standard” can be lower than STR

-

Guests include travel nurses, interns, project-based workers, people between homes, insurance-displaced families

-

-

Long-Term Rental (LTR):

-

Usually 6–12+ month leases

-

Often unfurnished

-

Residents are primary-home tenants (individuals, couples, families)

-

-

Your city or county may define these differently for licensing and zoning, so always check your local code and registration requirements before you commit to a strategy. This is one of the first steps I list in my Short-Term Rental Roadmap, and it’s a step many investors skip until it hurts.

2. STR vs MTR vs LTR: Side-by-Side Comparison Chart

6925f02aea172_lg.jpg)

3. How the Money Works: Revenue, Costs, and Taxes

Short-Term Rentals: High Revenue, High Input

Revenue:

-

Highest income per night, especially in strong vacation or event markets

-

Highly seasonal in many areas; cash flow can be feast or famine (and regardless of location, there are always some ebbs and flows!)

Costs:

-

Furnishings and décor to meet guest expectations

-

Platform fees (Airbnb, Vrbo, etc.)

-

High cleaning/turnover costs and deep cleans

-

Regulatory fees, local occupancy taxes, sometimes state-level sales/bed taxes

-

STR-specific insurance (usually higher than standard landlord policies)

Tax angle:

If your property meets the IRS definition of a short-term rental and you materially participate, your STR activity can be treated as non-passive, which is what makes the short-term rental “loophole” attractive for some investors.

That opens up the door to strategies like:

-

Short-term rental bonus depreciation on eligible assets

-

Using a cost segregation study to identify items that can be depreciated faster (furniture, certain improvements, etc.)

-

Combining bonus depreciation with active losses to offset W-2 or other active income in some cases

If you’re leaning toward STRs specifically for tax strategy, this is where my Tax Playbook goes into the nuts and bolts of the short-term rental loophole, material participation tests, and how bonus depreciation short term rental strategies can show big “paper losses” without losing real cash.

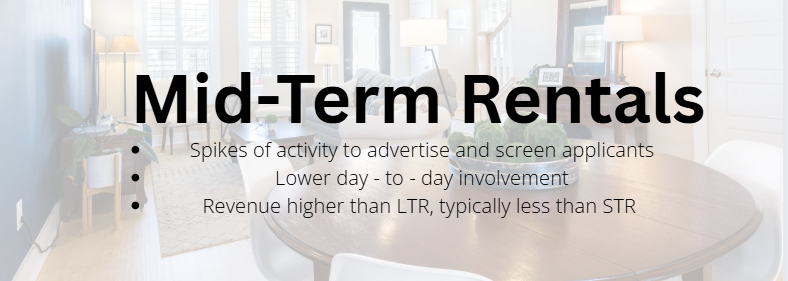

Mid-Term Rentals: The Middle Path

Revenue:

-

Monthly rent is usually higher than a true LTR because it’s furnished

-

But lower than a well-run STR on a per-night basis

-

Fewer “shoulder season” dips than pure vacation markets, especially if tied to hospitals, universities, or large employers

Costs:

-

Furnishing (can be simpler than STR)

-

Turnovers every few months, not every few days

-

Marketing across platforms (furnished rental sites, insurance housing networks, or direct outreach)

-

Owner often pays utilities and internet, but leases can include caps or overage charges

Tax angle:

-

Many MTRs do not qualify as short-term rentals for IRS purposes because stays often exceed 7 days on average

-

That means they’re treated more like standard rental property for tax purposes (passive income, standard depreciation), unless you qualify under broader real estate professional rules

-

You still get depreciation, just likely without the STR loophole twist

MTRs can be a great fit if you like the idea of furnished housing and better-than-LTR income, but don’t want to run a hospitality business.

Long-Term Rentals: Stability and Simplicity

Revenue:

-

Lowest revenue per day, but also the most predictable

-

In many markets, demand for long-term housing is strong and consistent

Costs:

-

Typically no furnishing cost (unless you choose a furnished LTR niche)

-

Lower regulatory burden in many places (but always verify)

-

Lower management fees (8–12% is common)

-

Tenants usually pay utilities; you cover major repairs and capital improvements

Tax angle:

-

Rental income is passive income and is reported on your tax return

-

You still benefit from depreciation on the building and certain improvements, over time

-

When you sell, any depreciation you claimed can be recaptured and taxed, which is where planning your exit (1031 exchanges, timing, etc.) matters.

You might not get the flashy short-term rental bonus depreciation stories here, but for many investors, LTRs are the backbone of a solid portfolio.

66e852d37d2f1_lg.jpg)

While the dollar amounts may differ market to market, its a good case study to highlight the cost differentials and strategy for the different rental types.

4. Regulations and Legal Risk

Regulation is one of the biggest swing factors between STR, MTR, and LTR, especially as regulations are being implemented in many markets limiting or even banning STR.

-

STRs are often heavily regulated, capped, or even banned in certain zones. Think permits, inspections, local occupancy taxes, and sometimes primary-residence requirements.

-

MTRs & LTRs generally fall under landlord-tenant law and standard rental registration (where required). They can still be impacted by rent control, eviction rules, or habitability standards, but they’re usually not in the crosshairs like STRs.

A few practical steps:

-

Read your local zoning and rental ordinances on your city or county website.

-

Search for “[your town] short term rental ordinance” and check recent city council agendas.

-

Call or email the zoning or planning department and ask them to point you to the relevant code sections.

-

Confirm:

-

Whether STR licenses are capped or tied to owners (vs properties)

-

Whether licenses transfer if you sell the property

-

What’s required for mid-term and long-term rentals (registration, inspections, etc.)

-

If your market is tourism-heavy with mature STR regulations, short-term may feel less risky. If your market is new to STRs and full of heated town hall debates, that risk increases.

Understanding the distinctions and operational implications of different rental durations is crucial for property owners aiming to navigate this complex landscape successfully. By staying informed and adaptable, property managers can strategically position their properties to optimize profitability and compliance across various markets.

5. Operations: How “Hands-On” Do You Want to Be?

This is where many investors realize, “Oh, I don’t actually want another job.”

STR Operations: You’re in Hospitality Now

Short-term rentals operate more like mini hotels:

-

Constant guest communication

-

Dynamic pricing and marketing (this is where tools like PriceLabs shine)

-

Turnover coordination, deep cleans, maintenance

-

Reviews and reputation management

-

24/7-ish availability for guest issues (AI tools can help minimize, but you still need someone available to esculate issues to any time, day or night!)

You can absolutely hire a property manager or co-host (typically 15–30%+), but even then, you’re running a business, not just owning a rental. I talk more about when it makes sense to outsource vs self-manage in The Short-Term Rental Roadmap

If you want to dive deep on revenue optimization for STRs, my Optimizer Course walks through pricing, listing, and operations for better performance.

MTR Operations: Fewer Stays, Deeper Relationships

MTRs feel like a hybrid:

-

Fewer turnovers (every 1–3 months vs every few days)

-

More intensive upfront screening – you’re often dealing with nurses, corporate clients, or insurers

-

Less “vacation-level” expectation on amenities, but they still need to be clean, functional, and comfortable

-

You’ll still coordinate cleaning, maintenance, and occasional in-stay issues

You can outsource placements and management, often for a flat fee per stay or a smaller percentage of rent - but keep in mind some PM's will charge the same as an STR, so ask! Operationally, it often feels like “LTR with furniture and more communication.”

LTR Operations: Lower Touch, But Big Moments

LTRs often look like:

-

Heavy lifting at turnover (make-ready, repairs, marketing, screening, move-in)

-

Then relatively steady-state operations: rent collection, occasional maintenance, lease renewals

-

You can set clearer communication expectations (e.g., emergency vs non-emergency timelines)

-

Many owners use a property manager at 8–12% of rent and only get involved for big decisions

If you want the lowest weekly time requirement, LTRs usually win.

6. Risk, Reward, and Matching the Strategy to Your Goals

Each rental strategy has its own risk profile:

-

STR risk:

-

Regulatory change

-

Seasonality / demand shocks

-

Revenue concentration on platforms

-

More moving parts = more chances for something to break

-

-

MTR risk:

-

Gaps between assignments

-

Over-reliance on a single demand driver (e.g., one hospital or one major employer)

-

Lease enforcement in gray areas (insurance placements, per diem workers)

-

-

LTR risk:

-

Tenant default or eviction (which can be slow and costly depending on your state)

-

Rent control or restrictive landlord-tenant laws in some markets

-

Slower ability to re-price to market if rents are rising quickly

-

Risk management strategies across all three:

-

Good insurance (for STR, consider specialized products or riders; I like partners such as Waivo for damage protection)

-

Solid rental agreements tailored to STR/MTR/LTR use

-

Conservative underwriting (this is where tools like AirDNA and a good spreadsheet help)

-

Strong screening processes for mid- and long-term tenants

Ultimately, your choice should reflect:

-

Your time and energy available

-

Your risk tolerance

-

Your tax strategy (is STR bonus depreciation a must-have, or a nice-to-have?)

-

Your lifestyle goals (vacation home you use vs pure investment)

7. Exit Strategy: Don’t Skip This Part

Before you choose a path, ask:

-

If STR is banned here next year, can this property still cash flow as an LTR or MTR?

-

If I use heavy bonus depreciation now, what is my plan for depreciation recapture later?

-

Will a future buyer care about STR income, or will this sell as a “normal” home at residential values?

Some things to keep in mind:

-

Many STRs are still valued more like residential property, not on cap rate (at least in most typical markets).

-

STR licenses may or may not transfer with the property – hugely important if you plan to sell to another STR investor.

-

You may choose to 1031 exchange into another property to defer taxes or use strategies like pairing a sale with a new purchase that generates additional bonus depreciation (“poor man’s 1031,” discussed more in my tax trainings).

And sometimes, your goal really is lifestyle, not max cash flow. One of my clients once said, “If the property breaks even, I’m still ahead,” because he wasn’t spending $15K a year on someone else’s beach house anymore. That’s a valid goal—as long as you define it clearly.

8. Putting It All Together: How to Decide

For ANY client, the first question I typically ask is "what's your goal?" This is key - because one persons version of success is not the same as another. Let your personal goals drive your decisions.

-

Clarify your goals.

-

Need to offset W-2 income now → STR may be worth the operational load

-

Want stable, set-it-and-mostly-forget-it income → LTR starts to shine

-

Want a balance with fewer turnovers and still above-LTR revenue → Explore MTR

-

-

Assess your market.

-

Strong tourism, mature STR rules → STR or STR+MTR hybrid

-

Strong employment center (hospital, university, corporate hub) → MTR

-

Solid, diverse local economy with housing demand → LTR

-

-

Map your time & personality.

-

Love hospitality, marketing, guest experience → STR

-

Prefer clear, longer relationships with residents → MTR/LTR

-

-

Check the numbers both ways.

Underwrite the same property as:-

An STR (using tools like AirDNA + dynamic pricing assumptions)

-

An MTR (furnished monthly stays)

-

An LTR (traditional lease)

Then ask:

“If the highest income version doesn’t work out, does the safest version still work for me?”

-

Recap: STR vs MTR vs LTR in One View

-

Short-Term Rentals (STRs):

Highest income potential and strongest tax play options (including STR bonus depreciation strategies), but they demand the most time and carry the most regulatory and operational complexity. -

Mid-Term Rentals (MTRs):

A middle ground with furnished stays and fewer turnovers, often ideal near hospitals, universities, or major employers. Great if you want decent income without running a full hospitality business. -

Long-Term Rentals (LTRs):

The workhorse of real estate: stable, simpler, and often the lowest weekly time commitment. Tax benefits are steady but less dramatic; returns are built on long-term, slow and steady growth.

Your best choice isn’t “what’s hottest on TikTok right now,” it’s what lines up with your goals, your time, your market, and your exit plan.

***

Appreciate this guide? Find it helpful? Help out a small business owner! Give a like/share.

Find Me on FACEBOOK or Instagram or LinkedIn as @theceohost

*****

Hey Boss! I'm Kate, owner/founder of The CEO Host. If you are interested in taking a leap into short-term rentals - or have some questions about your existing business, my goal - passion, and career, is to help YOU succeed. I've coached hundreds of folks getting started or looking to optimize, analyzed more deals (and duds) than I could count, completed thousands of hours of education and training, attended conferences... So don't be shy. A good CEO knows to bring in expert help - and that's what I'm here for! Lets HOP ON A CALL and chat!

Categories: : buying, STR finances taxes and risk management

Kate Stoermer

Kate Stoermer